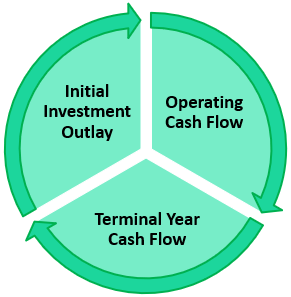

The new project can be anything from introducing a new product to opening a factory. In other words, it is basically the resulting increase in cash flow from operations due to the acceptance of new capital investment or a project. Incremental cash flow is the net cash flow from all cash inflows and outflows over a specific time and between two or more business choices. Incremental cash flow is the cash flow realized after a new project is accepted or a capital decision is taken. What are examples of incremental cash flows? In accounting, cash flow is the difference in amount of cash available at the beginning of a period (opening balance) and the amount at the end of that period (closing balance). Incomings and outgoings of cash, representing the operating activities of an organization. Other information: 40 marginal tax rate and a 12 hurdle rate. In making such estimation, it is important to consider the effect of acceptance of one project on the cash flows of another. Operating cash flows (OCFs) associated with a project can be derived from accounting earnings of the project and represent cash flows the project is expected to. While not specifically included in the definition of a relevant cash flow (as noted above) opportunity costs are also relevant cash flows.īeside above, how can you determine if a cash flow is incremental to a project? Incremental cash flows are estimated by comparing the company's net cash flows if the project is accepted and its cash flows if the project is not accepted. A definition often used for relevant cash flows states that they must be cash flows that occur in the future and are incremental. When it comes to your business accounting, there are a number of different formulas. Discounted cash flow (DCF) Sum of cash flow in period (1 + Discount rate) Period number. Operating cash flow Net income + Non-cash expenses Increases in working capital.

In this manner, is opportunity cost included in cash flow?ĭefinition. Cash flow forecast Beginning cash + Projected inflows Projected outflows. Incremental cash flow is important in capital budgeting. In the event that a reduction in the cash flow of another aspect or product is the result of taking on a new project, then it is called cannibalization.

0 kommentar(er)

0 kommentar(er)